Sure Group Secures ISO 9001:2015 Recertification with Zero Non-Conformities

Sure Group Secures ISO 9001:2015 Recertification with Zero Non-Conformities Sure Group is proud to announce that it has successfully passed its full, on-site ISO9001:2015 recertification audit — achieving this

Sure Group signs the UK Armed Forces Covenant

Sure Group is proud to announce that it has signed the UK Armed Forces Covenant, demonstrating its commitment to acknowledging and understanding the needs of

Sure Group’s 10th Anniversary Christmas Ball

What an evening! This year’s Christmas ball was more special than most because it marked Sure Group’s ten-year anniversary! Sure Group has embarked on a

Charles Draper shortlisted for Young Leader accolade in prestige leadership awards

Sure Group is proud to announce that Charles Draper, Managing Director, has been shortlisted for The Business Desk Yorkshire Leadership Awards 2024, in the Young

Government announces new welfare reforms to help thousands into work

As reported by the DWP, a consultation, launched on Tuesday, will consider changes to the Work Capability Assessment, with proposals to ensure it is delivering the right outcomes for supporting those most in need.

Labour market overview – labour market shifting to new ground

Info from ONS and REC The UK employment rate was estimated at 75.7% in April to June 2023, 0.1 percentage points lower than January to

July jobs outlook – employers feeling more positive about their own businesses

The latest Recruitment & Employment Confederation (REC) JobsOutlook shows employers feeling more positive about their business prospects – and slightly better about the wider economy.

Pay rise surprise leads to forecasts of higher interest rates

UK wages have risen at their fastest rate in 20 years, excluding the pandemic, raising expectations that UK interest rates will have to rise. Regular

Mental Health Awareness Week 2023

Job searching can be an exciting yet challenging phase in our lives. It often involves a rollercoaster of emotions, from anticipation and hope to frustration

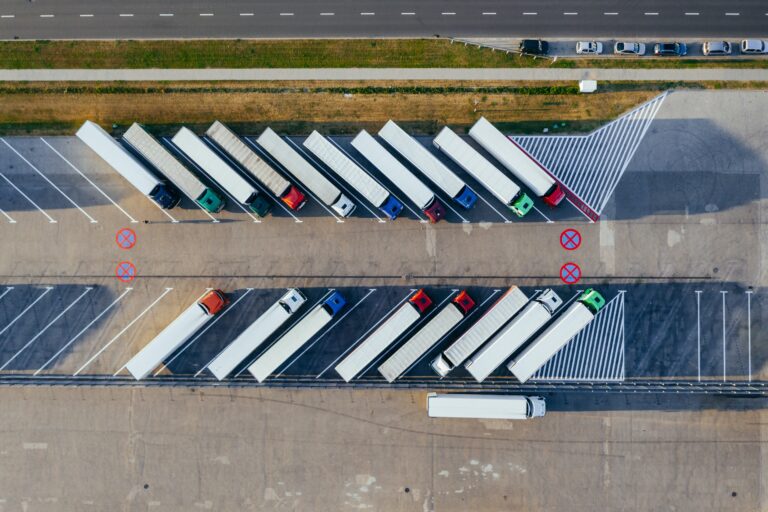

The hidden life of a lorry driver: long hours, fear of robberies – and living for the weekend

Article from the Guardian The Guardian has recently released an article which highlights the challenges that lorry drivers face by following a lorry driver in

Spring Budget 2023 reveals Government plans to boost economy

The Chancellor of the Exchequer, Jeremy Hunt, presented his 2023 Spring Budget to Parliament on 15th March and published documents with further details. In his speech, the

Four-day week trial achieves ‘incredible’ 92 per cent success rate, official report shows

Amid positive outcomes of the UK experiment, experts urge organisations to proceed with caution as many benefits will only be ‘truly identifiable in the long

Road Haulage Association calls on Chancellor to launch fuel duty rebate for transport operators

The RHA has called on Jeremy Hunt to launch a minimum 15 pence per litre fuel duty rebate for transport operators. They urge the Chancellor

Roundtable finds lack of digital skills lead to UK workers losing £5.7bn

A joint government, tech and finance industry roundtable has highlighted the need to signpost pathways to close the digital skills gap. UK workers are missing

Candidate shortage continues in 2023

A more cautious approach to staff hiring was evident at the start of 2023 amid ongoing economic uncertainty and cost pressures. The latest KPMG and REC,

Employers continue to turn to temporary staff to fill jobs

Employers continue to turn to temporary staff to fill jobs in the face of economic uncertainty and labour shortages, according to new Recruitment & Employment

Latest statistics from the ONS

The ONS (Office for National Statistics) have released the latest figures surrounding employment in the UK. Read on to learn more: Redundancies rose again to

Ways to beat Blue Monday

Blue Monday, thought to be the most depressing day of the year, falls on the third Monday of January every year. It is speculated to

UK employees will have the right to request flexible working from the moment they start a new job, under latest government proposals.

Employment Solicitor Alexandra Bullmore of East Midlands legal firm Smith Partnership examines the proposed changes in more detail and looks at what they mean for

Job vacancies and wage growth continue to fall, ONS reports.

The UK has recorded its second largest fall in real wage growth since records began over 20 years ago, in addition to yet another drop

Autumn Statement 2022

The Autumn Statement 2022 comes at a time of significant economic challenge for the UK and global economy. The conflict in Ukraine has contributed to

UK wages rising at highest rate in decades, but workers still struggling to stay afloat

The latest data from the Office for National Statistics (ONS) shows that regular pay increased by 5.7% in the year to September 2022, which was

Ways to protect your mental health while job searching – Mental Health Awareness Week 2022

We know that looking for a job can take its toll on your mental wellbeing. Whether it’s making lots of applications, facing knock-backs or simply

Government introduces bill that is set to shake up employment laws

The UK Government has recently introduced a bill which, if passed, could revoke some of the laws that were introduced to comply with European Union

Ambitious entrepreneur shortlisted for most prestigious recruitment award in UK

An ambitious entrepreneur has been shortlisted for the most prestigious recruitment award in the UK. Charles Draper, 30, of Hessle, has been shortlisted for a

Newly appointed finance director challenged with doubling recruitment company’s turnover in five years

A multidisciplinary recruitment company has announced ambitious growth plans for its newly appointed commercial and financial director. Mark Newby will join the Board of Directors

UK lorry driver figures plummet by over 50,000 within last four years.

The number of lorry drivers in Britain has plunged by 53,000 in four years, according to official figures. There has been a significant fall in

The global lack of drivers leads to growing costs of transportation, says Girteka

he ongoing disruption in global supply chains, for which the consequences of the pandemic and unceasing geopolitical tensions are most widely to blame, brings out

Parliament approves draft legislation to supply agency workers during strikes

Members of Parliament voted 284 to 202 on 11th July 2022 after a heated debate to approve draft legislation that will allow recruitment agencies to